working capital turnover ratio interpretation

Working capital is current assets minus current liabilities. There is a moderate negative correlation between cash turnover ratio and profitability of - 0485The high turnover of TABLE - 2.

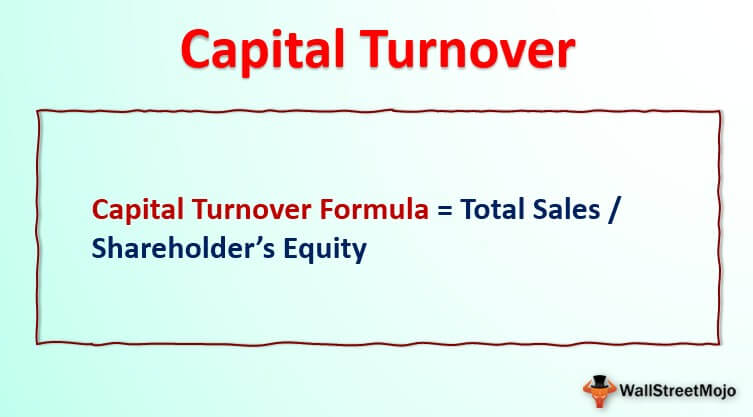

Capital Turnover Definition Formula Calculation

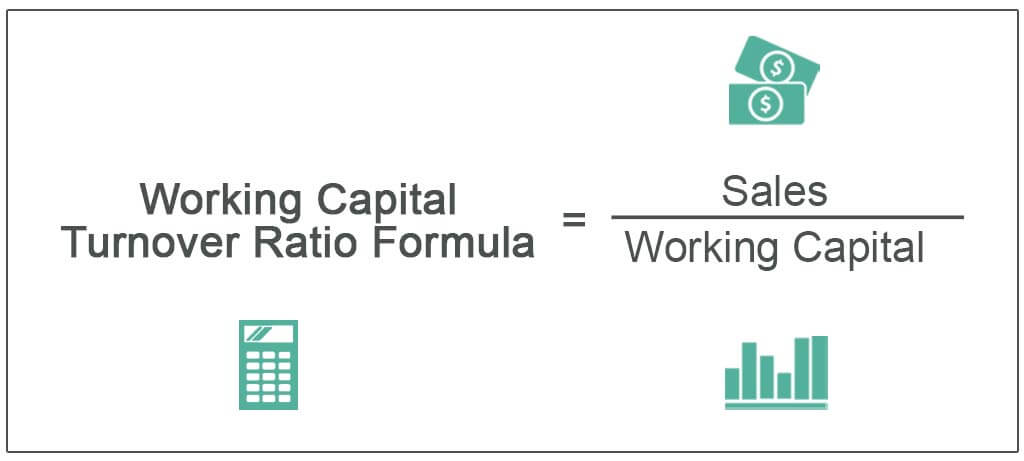

In principle the working capital turnover or net working capital turnover measures how much money a company required to run the business compared to its ability to generate revenues from operations.

. To understand more about this topic in greater depth visit Working Capital Turnover Ratio formula and interpretation. The ratio is very. What this means is that Walmart was able to generate Revenue in spite of having negative working capital.

A companys working capital turnover ratio can be negative when a companys current liabilities exceed its current assets. Working Capital Turnover Ratio Formula. The working capital turnover is calculated by taking a companys net.

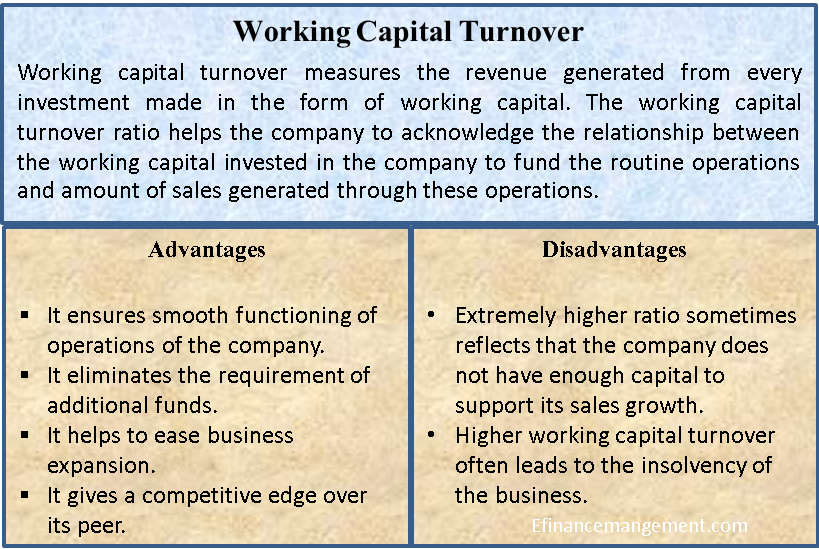

Working capital is very essential for the business. The working capital turnover is a ratio to quantify the proportion of net sales to working capital. This ratio shows the relationship between the funds used to finance the companys operations and the revenues a company generates in return.

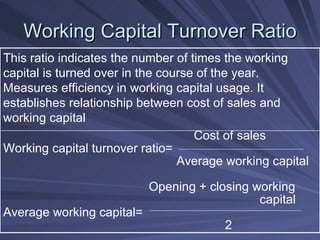

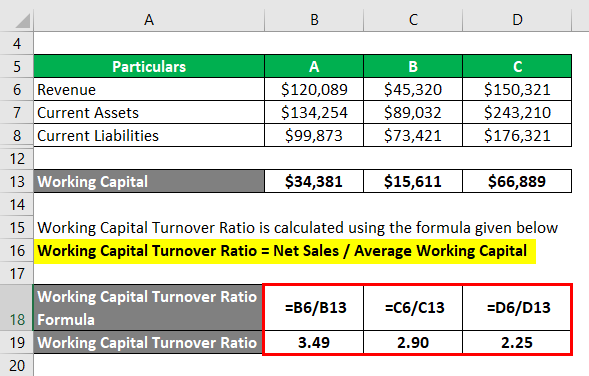

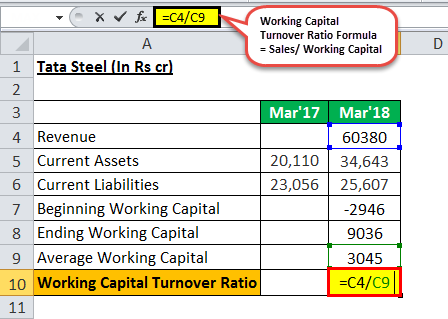

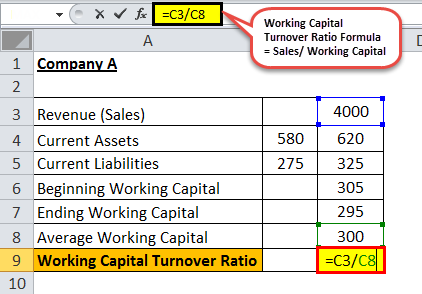

The Working Capital Turnover Ratio is also called Net Sales to Working Capital. Average working capital equals working capital at the beginning of the year plus working capital at year-end divided by 2. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2.

The working capital turnover ratio is a ratio of the turnover of the business to its working capital. The formula for this ratio is. This template helps you to calculate the ratio easily.

The working capital turnover ratio equals net sales for the year -- or sales minus refunds and discounts -- divided by average working capital. How do you interpret working capital turnover ratio. It is defined as the difference between the current assets and current liabilities and working capital turnover ratio establishes.

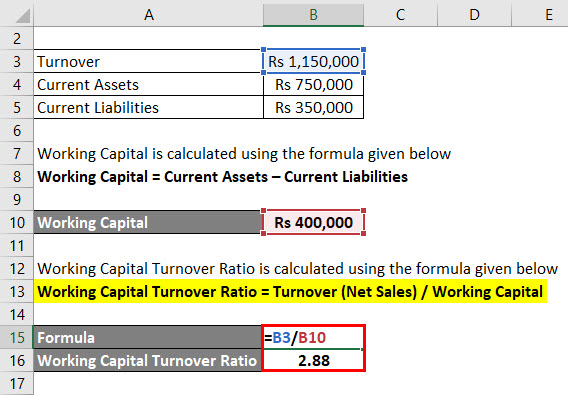

Working Capital Turnover Ratio Turnover Net Sales Working Capital. Where cost of sales Opening stock Net purchases Direct expends - Closing stock. The formula consists of two components net sales and average working capital.

A companys working capital ratio is a measure of its short-term ability to cover its financial liabilities. Working capital is the asset base after taking into account liabilities. Working capital turnover Net annual sales Working capital.

It can also be found with the formula. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue.

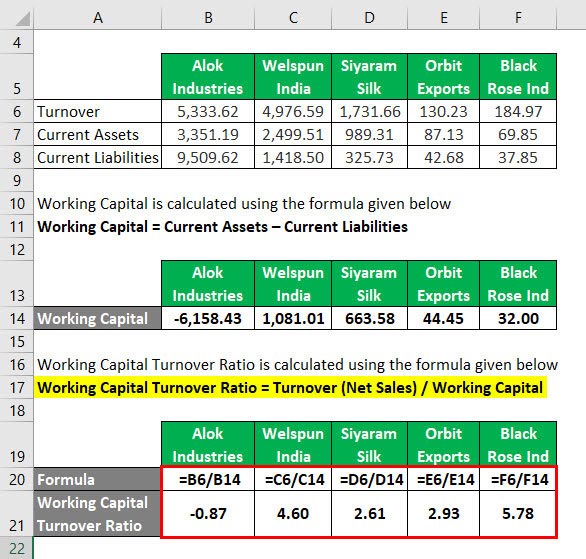

Click to see full answer. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times. Net Sales Average Working Capital 100.

Net working capital Current assets - Current liabilities. Working Capital Turnover Ratio is a financial ratio which shows how efficiently a company is utilizing its working capital to generate revenue. The working capital turnover ratio shows the companys ability to pay its current liabilities with its current assets.

Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the business and scale. The working capital turnover ratio is thus 12000000 2000000 60. A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to support sales.

It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time. Working capital turnover ratio interpretation. This means that every dollar of working capital produces 6 in revenue.

This ratio tries to build a relationship between the companys Revenue and Working Capital. Working Capital Turnover Ratio. However if the information regarding cost of sales and opening balance of.

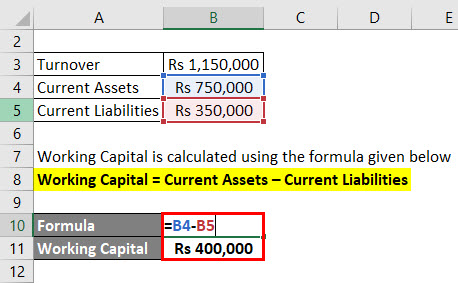

Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. Take the Next Step to Invest. The working capital of a company is the difference between the current assets and current liabilities of a company.

Working capital turnover also known as net sales to working capital is an efficiency ratio used to measure how the company is using its working capital to support a given level of sales. Working Capital Turnover Ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of the business. A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue.

Working capital ratio is found through the formula. Current cash assets divided by current liabilities. Working capital turnover ratio is computed by dividing the net sales by average working capital.

It measures how efficiently a business turns its working capital into increase sales. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as. SIMPLE CORRELATION ANALYSIS BETWEEN SELECTED RATIOS RELATING TO WORKING CAPITAL MANAGEMENT AND PROFITABILITY Year CR LR WTR ITR DTR CTR ROI 2005 208 187 229 1295 214 15469 051 2006 235 208 194 1175 193.

Average of networking capital is calculated as usual opening closing dividing by 2. The ratio can be used to evaluate the efficiency of a. The formula for calculating this ratio is by dividing the sales of the company by the working capital of the.

It signifies that how well a company is generating its sales with respect to the working capital of the company. We calculate it by dividing revenue by the average working capital. It is a measure of the ability of a business to use its working capital to support its turnover or revenues.

Working Capital Turnover Ratio 288. Working capital turnover ratio Cost of sales Average net working capital. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets.

Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

What Is The Working Capital Turnover Ratio Quora

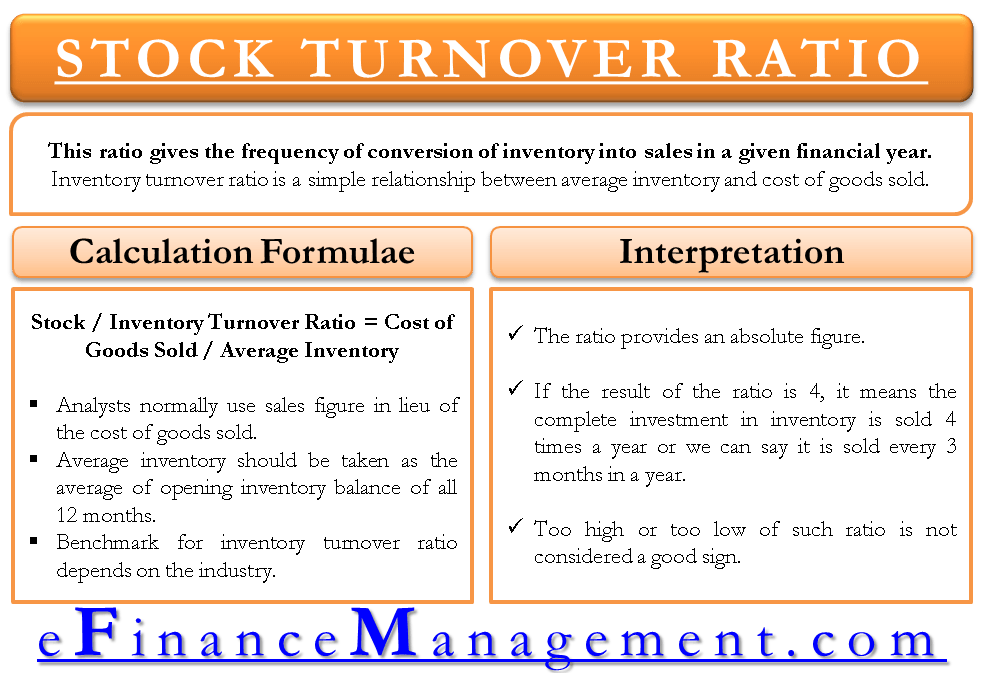

Stock Inventory Turnover Ratio Calculate Formula Benchmark

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Ratio Interpretation Financial Ratio

Working Capital Turnover Efinancemanagement Com

What Is Working Capital Turnover Ratio Accounting Capital

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template